Payments only to Micro and Small units registered under MSME Act-- New Provisions under section 43B(h) of the Income Tax Act

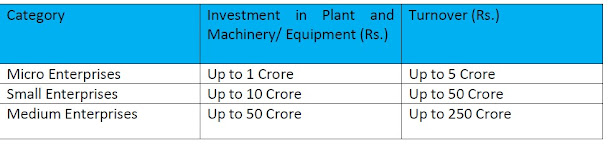

Introduction The government introduced new regulations through the Finance Bill 2023 to bolster the recovery of accounts receivable in the MSME sector. These regulations significantly impact the deductibility of payments made only to Micro and Small Enterprises under the Income Tax Act. Classification of MSMEs Classification of Micro, Small, and Medium enterprises is based on a composite criteria of investment in plant and machinery or equipment and annual turnover as prescribed: Key Takeaways: Ø Timely payments are crucial: To claim the expense deduction, business assessees must pay MSMEs within the time limits specified in the Micro, Small and Medium Enterprises Development Act, 2006 (MSMED Act). The payment thus must be made within 15 days from the acceptance of goods or services which may be extended to 45 days, if a mutual agreement exists. Ø Enterprise Size matters: The new rule only applies to micro and small enterprises, not medium enterprises engaged