Payments only to Micro and Small units registered under MSME Act-- New Provisions under section 43B(h) of the Income Tax Act

Introduction

The government introduced

new regulations through the Finance Bill 2023 to bolster the recovery of

accounts receivable in the MSME sector. These regulations significantly impact

the deductibility of payments made only to Micro and Small Enterprises under the

Income Tax Act.

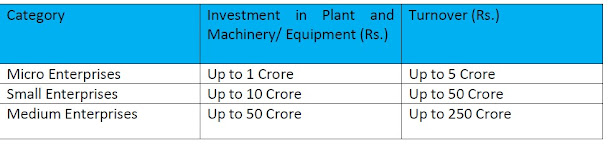

Classification of MSMEs

Classification of Micro, Small, and Medium enterprises is based on a composite criteria of investment in plant and machinery or equipment and annual turnover as prescribed:

Key Takeaways:

Ø Timely payments are crucial: To claim the expense deduction,

business assessees must pay MSMEs within the time limits specified in the

Micro, Small and Medium Enterprises Development Act, 2006 (MSMED Act). The

payment thus must be made within 15 days from the acceptance of goods or

services which may be extended to 45 days, if a mutual agreement exists.

Ø Enterprise Size matters: The new rule only applies to micro and small enterprises, not medium

enterprises engaged in manufacturing or rendering services.

Ø Exclusion: Regardless of their registration under the MSME Development

Act of 2006, Traders fall outside the definition of an enterprise. Therefore,

they are not typically eligible for benefits related to delayed payment

provisions outlined in the Act. This exclusion was clarified in an Office

Memorandum (1/4(1)/2021-P&G/Policy) issued by the MSME Policy Division on

September 1, 2021.

Ø Consequences of delay: Ignoring these new regulations can

be costly. Failing to pay on time will lead to:

Practical Aspects:

Ø New provisions apply to expenses/

purchases/ services billed on or after 01.04.2023.

Ø The deduction will be allowed only in the year of payment; payments made before the filing of the ITR are inconsequential.

Ø If there is any dispute, the time period starts after the dispute is resolved.

Staying

Compliant:

Ø Review your payment terms: Review the terms of purchase

agreements, ensure compliance with time limits specified in the MSMED Act.

Ø Ask for Udyam Certificate: Send a letter to verify your

suppliers’ MSME status’ by keeping record of their Udyam Certificate.

Ø Separate Supplier Database: Maintain a separate MSE supplier

database, tracking due dates and payments.

Ø Track your payments: Monitor the payments due to MSMEs

and prioritize settling these within the stipulated time.

Ø Seek professional advice: Consult a tax advisor for complex

business operations or uncertainties for personalized guidance.

Comments

Post a Comment